Introducing Fintilect’s Digital Banking Platform for Automotive Finance Clients

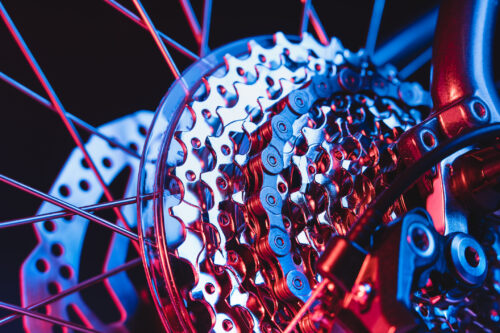

Fintilect’s automotive finance software solutions are driven by our Digital Banking Platform, which provides a fully flexible platform for vehicle dealerships. We are committed to helping clients shine in this ever-competitive market.